Agile transformations benefit from a bold and specific vision for the agile business that creates clarity and urgency and outlines the key mind shifts required. Using the example of the insurance industry this article discusses and illustrates the components that make up a bold agile vision.

The need for higher business agility

VUCA times need clarity, vision, understanding and agility to operate successfully in the increasingly dynamic markets.

Agile ways of working are already used by 91% of the businesses. After nearly 20 years since the start of the agile movement our understanding about the benefits and approaches of agile ways of working has matured making them ready for broader application across the business.

This comes at the right time as the need for higher levels of agility is greater than ever. For 63% of organizations becoming agile is an urgent strategic priority.

Facilitating the need for change

Changing your ways of working is never easy. As with any change, the success of an agile transformation depends on early wins. You want to start where it makes most sense and where the benefits are obvious. Your business also depends on it. VUCA markets do not wait.

Agile ways of working establish the primacy of the customer. From the customers teams work backwards to adopt and continuously adapt the ways of working to maximize customer value delivery. On the level of the business you work backwards from your preferred vision of the future.

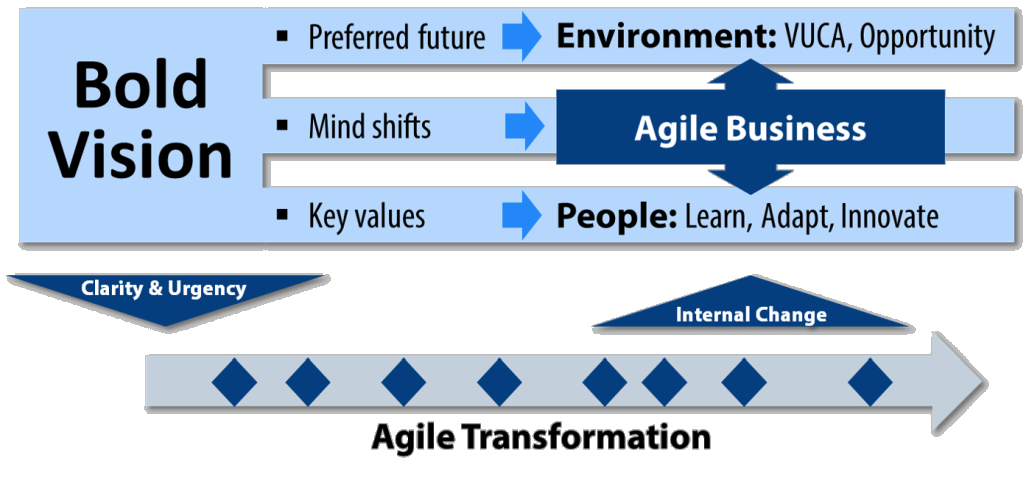

When embarking on an agile transformation the vision establishes the clarity and urgency about where to get started and guides the implementation. Here is how this could look like for insurances.

SWOT for insurances

The market dynamics we currently experience is driven by a wave of new combinatorial technologies that make IT pervasive and provide never-before-seen potential of automation.

New technologies and business models like home rentals, drones and autonomous cars are waiting for being insured. Just around the corner are cyber insurance, identity insurance, and coverage for the cannabis industry. This provides abundant opportunity for insurances. If they can assess and price the risks correctly.

Advanced analytics can automate underwriting and improve fraud detection, and IoT devices enable the monitoring of risks in real-time while drones allow for fast and easy remote assessments. The opportunities seem endless.

Risks result from an highly instable environment with a wave of change driven by technology, economic and social developments. These include the formation of ecosystems, post-demographic consumers but also the declining brand loyalty of millennials.

Irrespective of those opportunities and risks, insurances have a great strength: a flexible product that can be customized quickly to the needs of the customer or ecosystem partner. This is ideal for agile development.

Yet, the ability to bring the flexibility of the product to bear in those dynamic market conditions rests on the flexibility of the organization itself to organize accordingly.

Often, hierarchical and fixed structures, silos and traditional mindsets prevent insurers from reaping the benefits. The need for new, more agile ways of working emerges.

InsurTech companies like Lemonade, Insureon, Sure and Bolt are born agile while other, non-traditional entrants like Amazon and banks disrupt established business models further.

Established insurances need to understand these market conditions and make efforts to better serve their customers leveraging technology and data to realize the never-before-seen potential for the industry to customize products that are tailored towards the need of individual customers.

Defining a bold vision for an agile insurance

These insights inform the definition of a bold vision for your insurance. This vision provides the clarity from which you can work backwards and organize yourself accordingly adopting new, agile ways of working as needed.

Your vision needs to be bold and customer-focussed to provide enough external inspiration and urgency to make the often-difficult change to agile ways of working. If falls short, your people might feel that the old ways of working are still enough. Your agile transformation risks failing due to a weak vision.

For example, Oscar Healthcare realized that they needed to go “full-stack” by not just issuing insurance, but also gathering customer data, processing claims, getting involved with providers and clinical research, and more to help customers get higher quality care.

Adding mind shifts to the vision

An agile transformation starts with a different mindset that provides new perspectives on the way of working. Besides the market realities mentioned above, this new mindset also becomes part of the vision for your agile insurance. There are two parts to this.

The first part are common agile mind shifts that include valuing customer over standardization, people over processes and continuous learning over unconditional knowing.

The second part are industry or function specific mind shifts. For the insurance industry these may include moving from agency sales to direct digital sales, from paying for losses to assuring operational continuity and from customer ownership to ecosystems.

The MyBusinessAgility MyContext workshop is one way of getting started. In we use foresight methods to develop the initial version of your agile vision and develop relevant mind shifts to guide your agile transformation and inspire agile behaviours.

Using the vision to drive your agile transformation

Once you have established the vision for your agile business you can now decide where to get started in applying agile ways of working to get you there.

This could be at a very specific place, with a single team or even pilot serving a specific customer. It could concern an entire department or product group needing agile scaling. It could also affect your entire business, for example, with the adoption of portfolio management to enable agile decision-making and strategy definition.

With all the excitement about the new possibilities and agile, established, large insurances will pursue the path to higher levels of agility as hybrid organizations that balance the best of new and proven ways of working to ensure consistently high quality products, solid processes e.g. for claims settlement, compliance and solvency while improving innovation and customer-orientation.